Photovoltaic (PV) Panel Waste Volumes

Summary

Beyond general waste regulations, several approaches have been developed specifically to manage end-oflife PV panel waste. This series of issues summarizes the framework titles enabled as well as the financial principles of panel waste management.

Germany: Developed Market with EU Directed, Pv Specific Waste Regulations

Market Forecast for PV and Waste

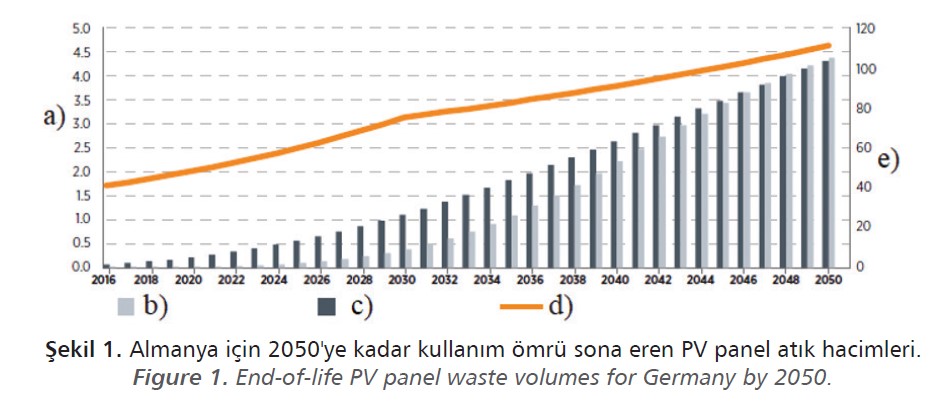

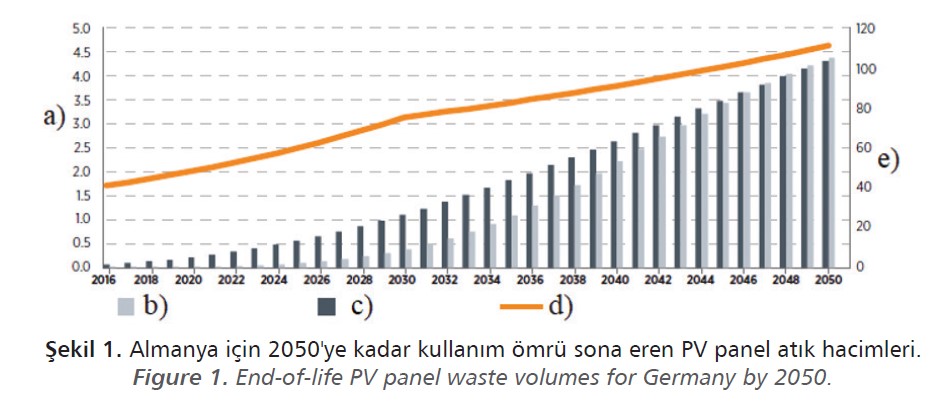

By 2016, it is anticipated that Germany’s end-of-life PV panel waste quantities will total between 3,500 t and 70,000 t. This is primarily because of the previously installed PV capacity.

The amount fluctuates depending on the scenario chosen. The regular-loss and early-loss

scenarios predict, respectively, between 400,000 and 1 million t and 4.3–4.4 million t by 2030 and 2050. (see Figure 1). In the coming years, Germany will undoubtedly rank among the top markets for PV recycling technology.

a) Cumulative PV panel waste (million t),

b) Normal loss scenario,

c) Early loss scenario,

d) Cumulative PV capacity,

e) Cumulative PV capacity (GW),

Governmental Action

The updated Electrical and Electronic Equipment Act (Elektroaltgerätegesetz, or ElektroG) was amended in October 2015 to incorporate the revised EU WEEE Directive (see preceding section) into German law. As a result, Germany has implemented new regulations for the collection and recycling of PV panels since that time.

The National Register for Trash Electrical Equipment (Stiftung Elektro- Altgeräte Register or Stiftung EAR) governs the treatment of electronic waste in Germany. Producers established

Stiftung EAR as their clearing house (Gemeinsame Stelle) during the implementation of the first WEEE Directive in order to submit applications to ElektroG. (see Box 10).

Stiftung EAR registers e-waste producers under the authority of the Federal Environment Agency (Umweltbundesamt). In all of Germany, it coordinates the delivery of containers

and pick-up at the öffentlich-rechtliche Entsorgungsträger (örE, public trash disposal authorities).

However, Stiftung EAR is not responsible for operational tasks such as collection, sorting, disassembly, recycling or disposal of e-waste. These are the responsibility of manufacturers

who have been responsible for e-waste recycling and disposal since March 2005 under the original Electrical and Electronic Equipment Act.

Overview of the Operations of the Stiftung EAR Clearinghouse

Stiftung EAR is financially and personnel independent. The Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety set fees and expenses for its operations that must be met (Bundesumweltministerium).

All e-waste producers, including those who make PV panels, can benefit from the services provided by the Stiftung EAR clearing house.

• Coordinates the provision of containers and e-waste takeback at the public waste disposal authorities (örE);

• Reports the annual flow of materials to the Federal Environment Agency ,

• Ensures that all registered producers may participate in the internal setting of rules, and identifies free riders and reports them to the Federal Environment Agency,

• Registers producers placing e-waste on the market in Germany, • Collects data on the amounts placed on the market,

• Coordinates the provision of containers and e-waste takeback at.

Adoption of the WEEE Directive

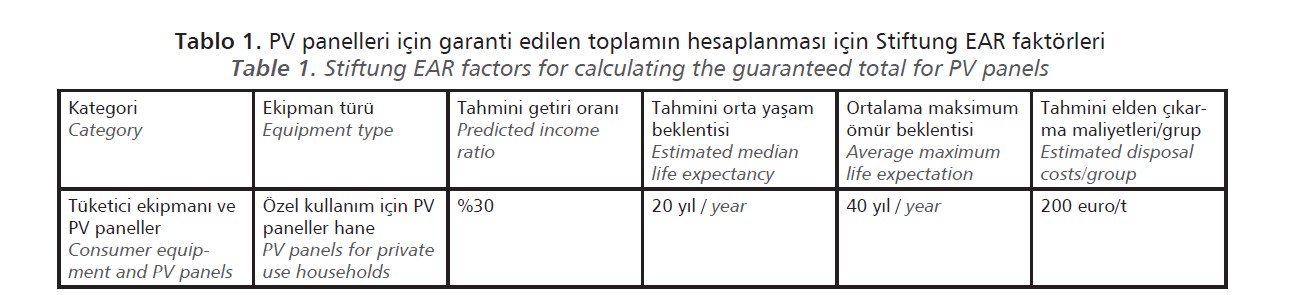

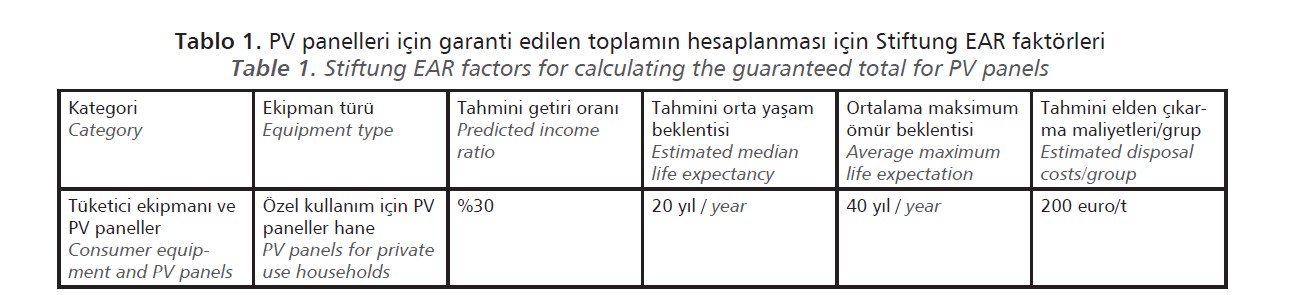

Germany has established particular requirements for PV panel collection, recovery, and recycling following the newly implemented WEEE Directive from 2015. (Table 1). These determine the amount of money that each producer must guarantee for each new panel that is sold.

Depending on the producer’s preferred method of financing, the guarantee calculation may vary. The idea can be understood if the producer chooses the joint-and-several responsibility structure for B2C panels sold by using the condensed formula below.

Cost responsibility is equal to the base amount for registration (PV panel tonnage sold) times the presumptive return rate (%) and the presumptive disposal expenses (in euros per ton).

The German regulatory body permits contractual agreements between the producer and owner of B2B PV panels to fulfill the requirements of the law, for instance through recycling service agreements.

In Germany, waste PV panels are collected and treated separately at municipal collection locations because there is a specific collecting category for them. This indicates that any PV panel owner who desires to dispose of their panel may do so for free at a municipal pickup location.

Private customers with home PV systems can dispose of them using this disposal route. However, because removing a PV panel calls for specialized knowledge, the majority of endof- life PV panels are anticipated to be returned via B2B networks.

However, because removing a PV panel calls for specialized knowledge, the majority of end-of-life PV panels are anticipated to be returned via B2B networks. This is due to the likelihood that installers who remove rooftop panels will also handle the disposal.

Either producers’ collection and recycling systems or B2B e-waste compliance programs will get these PV panels directly. There were a variety of non-regulatory activities that arranged

the collecting and recycling of end-of-life PV panels before the amended ElektroG was put into effect in Germany.

They were mostly founded on producers’ voluntary actions (e.g. PV CYCLE). These programs will either have to end or change to comply with the new law and register as B2B e-waste compliance programs.

Plans for National Funding Under the WEEE Directive

Given the enormous volumes of historical installed capacity in Germany that will be disposed of as waste, financing collection, recovery, and recycling in the coming years

is the most crucial component of the WEEE Directive. Depending on the type of transaction, the German government envisions two different procedures based on the WEEE Directive. The list of them is below.

Consumer-to-business (C2B) Transactions

The new ElektroG requires manufacturers who sell ewaste to private households (or other users with a similar need, such as dual-use e-waste) to satisfy related present and future end-of-life responsibilities.

This guarantees that when products are put on the market, manufacturers are taking care of the end-of-life management of PV panels sold to private households (for example, residential rooftop systems).

The strategy was developed as a result of prior experience with authorized producer compliance programs that use a joint-and-several liability structure, as shown in Figure 2.

The collective producer compliance system establishes two levels of operation and financing:

• Level 1 covers the operation of the collection system and costs associated with the immediate collection and recycling of products (including historical products released onto the market before being covered by the law’s purview).

• Level 2 makes ensuring that there is enough funding available for the future collection and recycling of products that are now on the market, i.e., after being included in the legal framework.

For the category of PV equipment, the prices serving as the foundation for Level 2 financing are standard. The regulator determines them by factoring in factors including the typical lifespan, the return threshold at municipal collection sites, treatment costs, and logistic costs.

All market players that place goods of a specific type (such as PV panels) on the market through B2C transactions are covered by a PAYG system. In addition, manufacturers must register with a clearing house before being given access to the market.

They must acknowledge that they have a contract in place to pay Level 2 expenses for B2C

items that are put on the market. Based on their current market share, they must also assume culpability for Level 1 costs (i.e. accepting the liability for other market participants).

The producer e-waste registration number that must be printed on the item and invoices is then given by the clearing house. How the producer will fulfill it’s Level 1 contribution is

now up to them. It might, for instance, operate its collection and recycling system or sign up for a cooperative system.

In any case, the expenses for gathering and recycling every piece of B2C trash from a certain product category are divided among all registered market players by the volume gathered. This guarantees that old garbage (or orphan rubbish in the case of goods produced by nowdefunct businesses) is gathered and dealt with.

If a producer proves that it separately collected and recycled its portion, those volumes will be subtracted from the remainder. If one manufacturer leaves the market, the others

will assume responsibility for funding collection and recycling as well as its market share.

Every manufacturer must also make sure that there is enough Level 2 funding

available for B2C products that are currently being sold. If the joint Level 1 system keeps functioning, this happens on its own. However, last-man-standing insurance must provide funding if all manufacturers in a particular product category cease operations.

All Level 1 participants pay an annual fee for insurance that ensures costs are paid for if all market participants cease to exist. Since it is extremely unlikely that every market participant will vanish, this premium is typically relatively small.

B2B (business-to-business) Exchanges About volumes, size, degree of complexity, etc., Germany’s new ElektroG offers a distinct method of funding end-of-life PV obligations for manufacturers who solely sell products on a B2B basis. This is so that collection and

recycling can be planned more efficiently if the owner of the final piece of equipment or installation does so.

The contractual parties must agree on the end-of-life obligations outlined by the WEEE Directive, either by hiring the producer to collect and recycle or by soliciting quotes

from the market. The B2B strategy gives both parties the freedom to choose a finance or financing mechanism.

This will most likely lead to models for large-scale PV facilities that provide money for collecting and recycling from nearly commercial end-of-life project revenue flows.

In order to enable contractual partners to fulfill previously agreed (pre-WEEE) end-of-life commitments, very costeffective finance will be made available. Thus, historical trash volumes will be included.

Prospects for Germany

The market for recycling end-of-life PV panels in Germany is most likely to be the first to achieve viable economies of scale. The regulator’s assessment of the present disposal

costs is consistent with the average treatment costs shown in Table 1 above.

However, as waste production increases, these costs ought to decline after the sector has

experienced a learning curve. Other areas of the e-waste stream have already shown this pattern.

The advancement of recycling solutions for the various PV technology families is now being driven by some R&D activities. These seek to further cut the price of recycling while raising the potential revenue streams from the secondary raw materials that are recovered during recycling.

In our next article, we will continue the WEEE targets and financing plans of the UK, I wish you a healthy day...

Dr. Cemil Koyunoğlu

Energy Systems Engineering

Engineering Faculty

Yalova University

a) Cumulative PV panel waste (million t),

b) Normal loss scenario,

c) Early loss scenario,

d) Cumulative PV capacity,

e) Cumulative PV capacity (GW),

a) Cumulative PV panel waste (million t),

b) Normal loss scenario,

c) Early loss scenario,

d) Cumulative PV capacity,

e) Cumulative PV capacity (GW),

The collective producer compliance system establishes two levels of operation and financing:

• Level 1 covers the operation of the collection system and costs associated with the immediate collection and recycling of products (including historical products released onto the market before being covered by the law’s purview).

• Level 2 makes ensuring that there is enough funding available for the future collection and recycling of products that are now on the market, i.e., after being included in the legal framework.

For the category of PV equipment, the prices serving as the foundation for Level 2 financing are standard. The regulator determines them by factoring in factors including the typical lifespan, the return threshold at municipal collection sites, treatment costs, and logistic costs.

The collective producer compliance system establishes two levels of operation and financing:

• Level 1 covers the operation of the collection system and costs associated with the immediate collection and recycling of products (including historical products released onto the market before being covered by the law’s purview).

• Level 2 makes ensuring that there is enough funding available for the future collection and recycling of products that are now on the market, i.e., after being included in the legal framework.

For the category of PV equipment, the prices serving as the foundation for Level 2 financing are standard. The regulator determines them by factoring in factors including the typical lifespan, the return threshold at municipal collection sites, treatment costs, and logistic costs.

All market players that place goods of a specific type (such as PV panels) on the market through B2C transactions are covered by a PAYG system. In addition, manufacturers must register with a clearing house before being given access to the market.

They must acknowledge that they have a contract in place to pay Level 2 expenses for B2C

items that are put on the market. Based on their current market share, they must also assume culpability for Level 1 costs (i.e. accepting the liability for other market participants).

The producer e-waste registration number that must be printed on the item and invoices is then given by the clearing house. How the producer will fulfill it’s Level 1 contribution is

now up to them. It might, for instance, operate its collection and recycling system or sign up for a cooperative system.

In any case, the expenses for gathering and recycling every piece of B2C trash from a certain product category are divided among all registered market players by the volume gathered. This guarantees that old garbage (or orphan rubbish in the case of goods produced by nowdefunct businesses) is gathered and dealt with.

If a producer proves that it separately collected and recycled its portion, those volumes will be subtracted from the remainder. If one manufacturer leaves the market, the others

will assume responsibility for funding collection and recycling as well as its market share.

Every manufacturer must also make sure that there is enough Level 2 funding

available for B2C products that are currently being sold. If the joint Level 1 system keeps functioning, this happens on its own. However, last-man-standing insurance must provide funding if all manufacturers in a particular product category cease operations.

All Level 1 participants pay an annual fee for insurance that ensures costs are paid for if all market participants cease to exist. Since it is extremely unlikely that every market participant will vanish, this premium is typically relatively small.

B2B (business-to-business) Exchanges About volumes, size, degree of complexity, etc., Germany’s new ElektroG offers a distinct method of funding end-of-life PV obligations for manufacturers who solely sell products on a B2B basis. This is so that collection and

recycling can be planned more efficiently if the owner of the final piece of equipment or installation does so.

The contractual parties must agree on the end-of-life obligations outlined by the WEEE Directive, either by hiring the producer to collect and recycle or by soliciting quotes

from the market. The B2B strategy gives both parties the freedom to choose a finance or financing mechanism.

This will most likely lead to models for large-scale PV facilities that provide money for collecting and recycling from nearly commercial end-of-life project revenue flows.

In order to enable contractual partners to fulfill previously agreed (pre-WEEE) end-of-life commitments, very costeffective finance will be made available. Thus, historical trash volumes will be included.

All market players that place goods of a specific type (such as PV panels) on the market through B2C transactions are covered by a PAYG system. In addition, manufacturers must register with a clearing house before being given access to the market.

They must acknowledge that they have a contract in place to pay Level 2 expenses for B2C

items that are put on the market. Based on their current market share, they must also assume culpability for Level 1 costs (i.e. accepting the liability for other market participants).

The producer e-waste registration number that must be printed on the item and invoices is then given by the clearing house. How the producer will fulfill it’s Level 1 contribution is

now up to them. It might, for instance, operate its collection and recycling system or sign up for a cooperative system.

In any case, the expenses for gathering and recycling every piece of B2C trash from a certain product category are divided among all registered market players by the volume gathered. This guarantees that old garbage (or orphan rubbish in the case of goods produced by nowdefunct businesses) is gathered and dealt with.

If a producer proves that it separately collected and recycled its portion, those volumes will be subtracted from the remainder. If one manufacturer leaves the market, the others

will assume responsibility for funding collection and recycling as well as its market share.

Every manufacturer must also make sure that there is enough Level 2 funding

available for B2C products that are currently being sold. If the joint Level 1 system keeps functioning, this happens on its own. However, last-man-standing insurance must provide funding if all manufacturers in a particular product category cease operations.

All Level 1 participants pay an annual fee for insurance that ensures costs are paid for if all market participants cease to exist. Since it is extremely unlikely that every market participant will vanish, this premium is typically relatively small.

B2B (business-to-business) Exchanges About volumes, size, degree of complexity, etc., Germany’s new ElektroG offers a distinct method of funding end-of-life PV obligations for manufacturers who solely sell products on a B2B basis. This is so that collection and

recycling can be planned more efficiently if the owner of the final piece of equipment or installation does so.

The contractual parties must agree on the end-of-life obligations outlined by the WEEE Directive, either by hiring the producer to collect and recycle or by soliciting quotes

from the market. The B2B strategy gives both parties the freedom to choose a finance or financing mechanism.

This will most likely lead to models for large-scale PV facilities that provide money for collecting and recycling from nearly commercial end-of-life project revenue flows.

In order to enable contractual partners to fulfill previously agreed (pre-WEEE) end-of-life commitments, very costeffective finance will be made available. Thus, historical trash volumes will be included.